Bridging the Gaps in Healthcare Services – In the Spirit of Florence Nightingale

Florence Nightingale is known as the founder of modern nursing. She transformed nursing globally with her faith in God and her patient-centric approach to nursing. Even though she lived in the 1880’s and early 20th century and without the technologies available to us today, Florence was also known for being a statistician. She used to measure monthly medical outcomes, such as deaths and their causes using a Polar Area Diagram. (Source: Florence Nightingale: The pioneer statistician | Science Museum) What is notable about using statistics, CaseMed through its InsurHealth Affinity Group business has aligned with CareBridge International which elevates medical data analytics to a new level and provides greater medical quality data as we work through case management files for our customers.

Florence brought nursing to several wars in her lifetime and developed hospitals and nurse training center. Florence Nightingale in her extensive life of service embodied what we strive to emulate in the Holistic Coordination of Patient Care model that Florence initiated over 100 years earlier.

“The very first requirements in a hospital is that it should do the sick no harm.”

~ Florence Nightingale.

THE INSURHEALTH AFFINITY GROUP, LLC

Growing Case Management and Healthcare Services | National Integrated Resources Network with a Special Focus on the Total Coordination of Patient Care

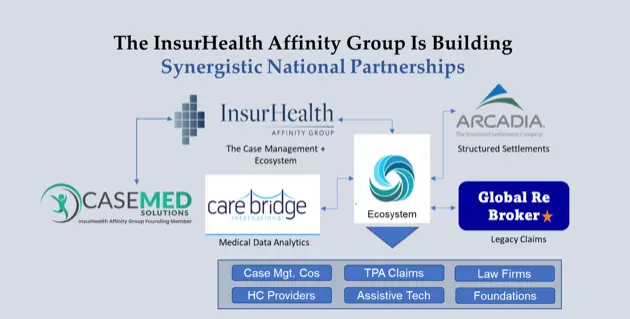

CaseMed Solutions is the founding member establishing and developing The InsurHealth Affinity Group LLC company (Affinity Group). Why InsurHealth? Because of the synergies in business that CaseMed and other case management companies have between insurance companies and healthcare organizations. The Affinity Group is designed to create collaborative alliances with other case management companies, healthcare providers and their other business synergies to join InsurHealth’s “Ecosystem Business Model/Network”. Since every company has an “affinity of business relationships and resources,” the Affinity Group has the ability to expand all Affinity Group members into a national network services business and the Affinity Group customers will enjoy an expanded array of case management and healthcare services.

What sets InsurHealth apart from other single-focused business alliances and networks is

Integration

The Affinity Group integrates Case Management companies with: Healthcare Providers, Third Party Administrators Claims (TPA Claims) organizations, P&C/L&A Insurance Companies, Law Firms, Cities/Counties/Municipalities, School Districts/Universities and Self-Insured Corporations and welcomes them to become Affinity Group members.

Equity

The Affinity Group offers Equity and Associate Memberships in the Affinity Group for those companies who want to participate in the Affinity Group’s “Integrated Network Economy (INE)” Commerce.

INSURHEALTH STRATEGIC BUSINESS PARTNERS

Partnering the Best of the Best for National Holistic Healthcare Solutions

CaseMed and the InsurHealth’s management team will continually seek those national companies that can provide significant value to its Affinity Group member customers and the holistic coordination of care for the client patients we all serve.

ARCADIA SETTLEMENTS GROUP

Holistic Healthcare and Financial Security for the Injured Person – Settlement Solutions

CaseMed through its InsurHealth Affinity Group is promoting greater healthcare and financial security for injured persons with the use of holistic coordination of patient care and settlement solutions offered through a partnership with Arcadia Settlements Group. The medical evaluation and long-term healthcare needs and rehabilitation is a critical component to a successful recovery. This requires early involvement and the development of accurate and fair Life Care Plans (LCPs). A properly developed LCP provides a fact-based guide for the respective attorneys to agree on the medical damages and provide the basis for settlement without proceeding to trial.

Statistically, 80% of all personal and physical injury claims and litigations are settled for cash only. In such situations, the injured party generally runs out of settlement monies (or settlement funds) within 5 years. Working with Team Arcadia and InsurHealth’s network of partners, the injured person can better understand the importance of having a customized LCP specialist work in tandem with Arcadia to create a balanced plan that meets the medical and financial needs of the injured. By providing alternative financial solutions to cash settlements, such as structured settlements, the injured party can focus on recovery without fear of becoming a statistic.

Team Arcadia is your proven partner for solution driven expertise. At Arcadia Settlements Group, we are experts who care about what matters to you.

Learn more about Team Arcadia and how our services and national consulting team can complement and develop the right solution for the injured party and strategy for settlement by vising our website https://teamarcadia.com.

MEDICAL-LEGAL SOLUTIONS

Accurate Medical Data Analytics – Improving Claims Reserving and Claim Settlements

CaseMed is excited to introduce Medical-Legal Solutions to our regional practice and nationally through InsurHealth. Deborah Watkins, Founder and CEO has developed Best-in-Class medical data analytic solutions concerning Work Comp claims utilizing Artificial Intelligence (AI) and Machine Learning (ML) technologies. Medical-Legal Solution's “Analytic-Powered Outcomes®“ technology solutions have been actuarially endorsed for its data, methods, and processes and the ONLY actuary Medicare Secondary Payer and Medical Reserve provider in the Property & Casualty insurance industry.

What Medical-Legal Solutions offers to CaseMed and InsurHealth is a higher quality and accuracy of medical claims data as our nurse case manager apply their medical expertise and project reports to our customers. We can then blend Medical-Legal Solution's analytics with our analyses of the patient client’s healthcare requirements for rehabilitation and settlement of claims.

Medical-Legal Solutions also provides us with service capabilities related to:

- Claims Reserve Setting/ Medical Forecasting

- Full Scope of Medicare Secondary Payer (MSP) Compliance including Professional Medicare Set Asides and Analytic-Powered (date driven) Medicare Set Asides

- Legacy Claims Solutions

- Life Care Planning

- Digital Journey Mapping & Support

GLOBAL RE BROKER (RE BROKER)

Leveraging InsurHealth’s Ecosystem Business Model to Support Opportunities for Buyers and Sellers of Legacy Claim Books – Reassessing Aged Claim Files for Runoff

InsurHealth has formed an alliance with a Global Reinsurance Broker that has a special claims practice providing alternative capital solutions for customers who want to reduce their long-tail legacy claims transactions and liabilities and who want relief from capital and operational burdens of managing a legacy business. In addition to some of the larger Property & Casualty companies, Re Broker’s customers are many times Risk Retention Groups (RRGs) and Captive Insurance Companies (Captives) specializing in large books of legacy claims. Where Re Broker and InsurHealth intersect is on the more catastrophic claims in those books, such as serious spine and brain injured patient claimants.

The InsurHealth advantage for Re Broker is that we have formed a synergistic relationship for Re Broker with the InsurHealth Case Management Companies, Team Arcadia and Medical-Legal Solutions that can blend each other’s services to support the best understanding of the catastrophic claims in the legacy books that may need reassessment. Once those assessments are completed, Re Broker can develop the Buy/Sell agreements and pricing for their customers.